how to put instacart on taxes

That may not seem like much but in a typical day can save you 28 57 or more depending on how much you drive. For simplicity my accountant suggested using 30 to estimate taxes.

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support

Estimate what you think your income will be and multiply by the various tax rates.

. Remember you may not get a 1099 if you made less than 600 during the previous calendar year. Can you file your Instacart taxes if you havent received your 1099. Its typically the best option for most Instacart shoppers.

Premium federal filing is 100 free with no upgrades for premium taxes. Youll be getting a 1099 from Instacart in early 2021 for the 2020 tax year. Stripe Express allows you to review your tax information download your tax forms and track your earnings.

As a 1099 shopper youll need to learn how to manage your taxes. Register your Instacart payment card. This includes self-employment taxes and income taxes.

We suggest you put a reminder on your phone. You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits. The taxes on your Instacart income wont be high since most drivers are making around 11 every hour.

I earned 600 or more in 2021. Independent contractors have to sign a contractor agreement and W-9 tax form. Instacart Membership fee and other fees are subject to applicable taxes.

This means for every mile you drive you pay 057 less in taxes. Except despite everything you have to put aside a portion of the cash you make every week to cover them. Depending on your state youll likely owe 20-25 on your earnings from instacart.

First make sure you are keeping track of your mileage. With tax season in full swing we want to ensure the shopper community has access to the resources you may need to file your taxes. This will take you directly to the section where you can enter your 1099-MISC.

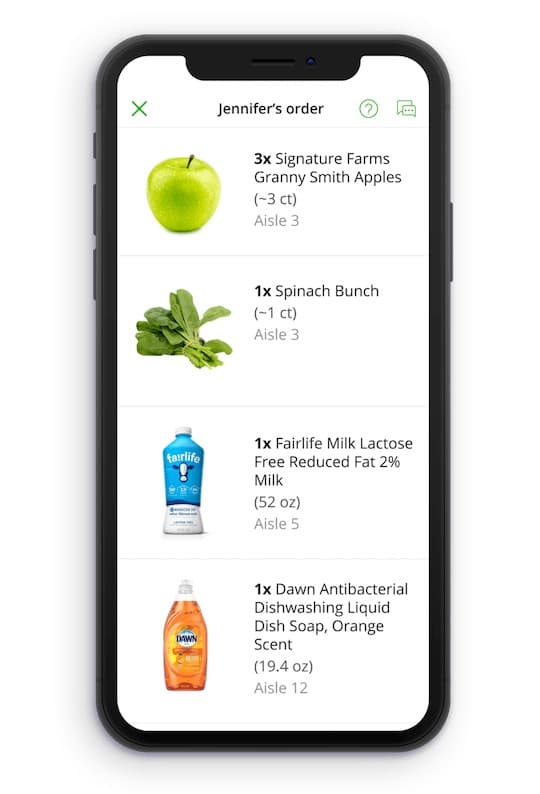

You expect your withholding and credits to be less than the smaller of. The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. Instacart shoppers use a preloaded payment card when they check out with a customers order.

Sign and date the form and give to the requester. Top 10 Tax Deductions for Instacart Personal Shoppers 2022. 90 of the tax to be shown on your current years tax return or 100 of the tax shown on your prior years tax return.

This rate covers all the costs of operating your vehicle like gas depreciation oil changes and repairs. Fill out the paperwork. For example suppose you use your phone 30 for delivery food and 70 for personal use.

Next year you will receive a 1099-MISC for the work you perform for Instacart if greater than 600. Your Business name for item 2 can be the same as your name in 1. Gig workers must pay federal income taxes and a 153 self-employment tax on earnings above 400.

Instacart has until January 31st to send a 1099-NEC to all shoppers who earned at least 600 in the previous year. Being an Instacart 1099 personal delivery driver can be a great way to earn some extra cash. If you earned 600 or more in 2021 through Instacart in the US Stripe will send an email titled Confirm your tax information with Instacart inviting you to create an account and log in to Stripe Express.

The estimated rate accounts for Fed payroll and income taxes. The Standard IRS Mileage Deduction. If you have an expense that is both personal and business then you need to allocate it between the two.

Tax tips for Instacart Shoppers. Up to 5 cash back Instacart. Today we are announcing a new partnership with TurboTax offering Instacart shoppers a discount on their TurboTax Self-Employed product.

On average shoppers can make an extra 200 to 500 per week from freelancing through this app. For Instacart to send you a 1099 you need to earn at least 600 in a calendar. If you work with Instacart as a Shopper in the US visit our Stripe Express support site to learn more about 1099s and how to review your tax information and download your tax forms.

Youre technically an independent contractor and youre supposed to file estimated taxes each quarter. Instacart sends their tax forms using Payable. For 2021 the rate was 56 cents per mile.

Learn how to file your 1040 and reduce taxes as an Instacart shopper in. Learn the basic of filing your taxes as an independent contractor. There are a few different taxes involved when you place an order Sales tax.

Then complete your address information and your Taxpayer Identification Number. For Instacart to send you a 1099 you need to earn at least 600 in a calendar year. The IRS establishes the deadlines for the payment.

The sales tax may be applied to some or all of the items in your order in accordance with local laws depending on the address of the store or your delivery address. Start Instacart Tax Return Instacart Shoppers Qualify for a Forgivable loan. Instacart partners with Stripe to file 1099 tax forms that summarize Shoppers earnings.

1099 tax forms for Instacart Shoppers. You can deduct a fixed rate of 585 cents per mile in 2022. TurboTax Self-Employed is designed to.

How do you get your 1099-NEC from Instacart. As an independent contractor you must pay taxes on your Instacart earnings. Part-time employees sign an offer letter and W-4 tax form.

Ad Federal Tax Filing is Always Free for Everyone. If an expense is only business related then no allocation is required. Deductions are important and the biggest one is the standard mileage deduction so keep track of your miles.

Pay Instacart Quarterly Taxes. After the new year starts youll receive your tax form in the mail. Missing quarterlydeadlines can mean accruing penalties and interest.

As youre liable for paying the essential state and government income taxes on the cash you make delivering for Instacart. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. For 2020 the mileage reimbursement amount is 057.

This includes driving for Uber or.

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart Instacart Rideshare Grubhub

How To File Your Taxes As An Instacart Shopper Contact Free Taxes

Instacart Reviews 2 020 Reviews Of Instacart Com Sitejabber

Instacart Q A 2020 Taxes Tips And More Youtube

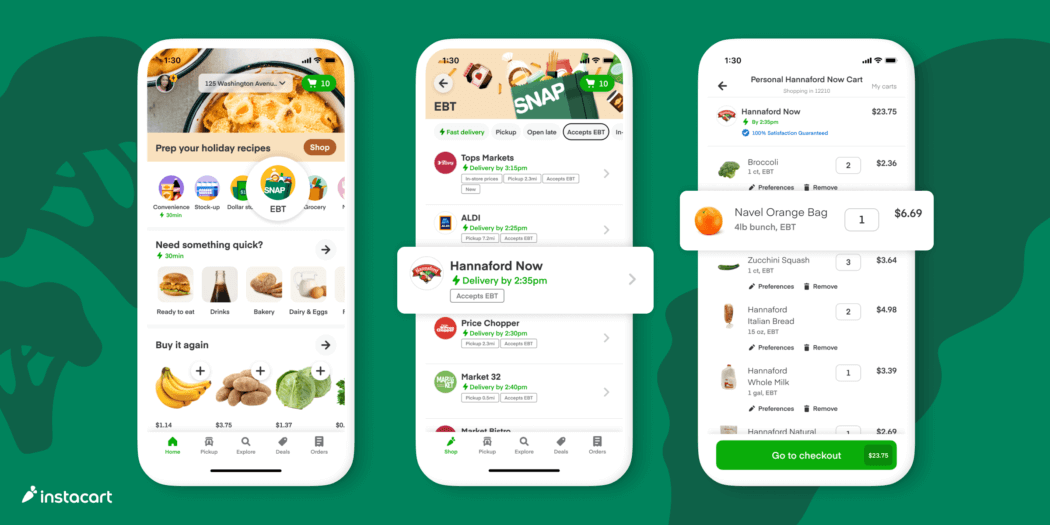

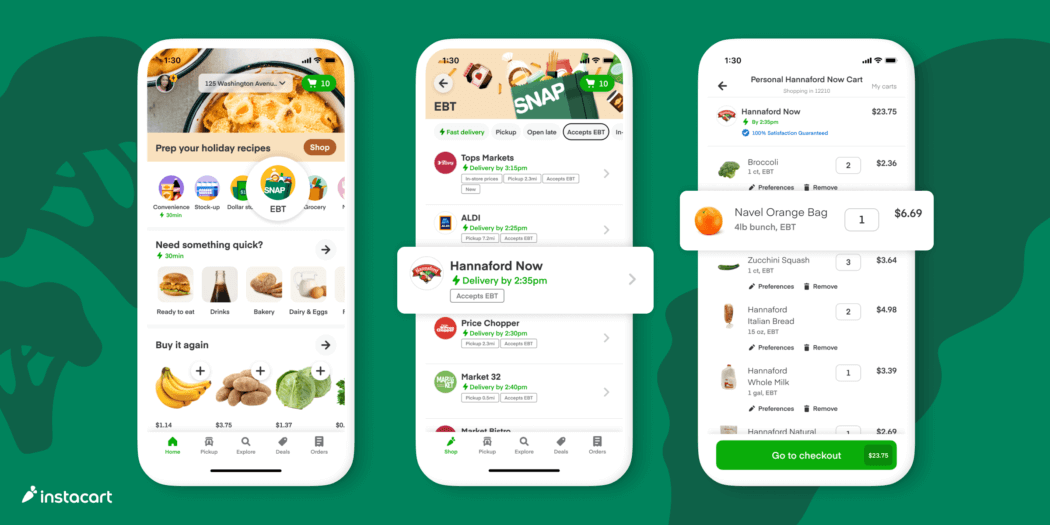

Instacart Expands Ebt Snap Payments Program And Celebrates One Year Of Increasing Access To Food

Drive With Instacart In Mobile Instacart Com

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart 1099 Taxes

What You Need To Know About Instacart 1099 Taxes

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart Taxes Net Pay Advance

How To Get Instacart Tax 1099 Forms Youtube

Instacart Unveils New Driver Safety Measures Pymnts Com

What You Need To Know About Instacart Taxes Net Pay Advance

Shopper Delivery Driver Thank You Card Sticker Thank You Note Etsy Business Card Displays Custom Business Cards Thank You Cards

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube